Best Automated Reconciliation System: How to Choose?

Here’s something we can all agree on - account reconciliation is time-consuming, but necessary. Luckily, an automated reconciliation system can make the entire process easier, efficient, and more accurate. But, how do you know what the best reconciliation software is?

Coming Up

What is Automatic Reconciliation?

What are the Benefits of Automated Reconciliation Software?

What are the Drawbacks of Automated Reconciliation Software?

Why use Automated Reconciliation Software?

Why is Account Reconciliation Important?

What is Account Reconciliation Software?

What is the Best Account Reconciliation Software?

What is Automatic Reconciliation?

Automatic reconciliation is exactly what it sounds like: a reconciliation process that is automated with the help of technological tools that alleviate manual labor.

Rather than having to collect data from disparate systems, perform transaction matching between internal and external documentation, and create reports, the software solution, such as Solvexia, handles all the steps for your team.

Since most companies perform reconciliation at least once a month, generally as part of the financial close process, automatic reconciliation ends up saving a ton of time on a continuous basis.

What are the Benefits of Automated Reconciliation Software?

Automated reconciliation software transforms how your finance team has to work and what they get to spend their time on. Rather than having to be bogged down with tedious tasks, they can provide strategic advice and dive into valuable insights, while automation software takes care of the menial responsibilities.

Some of the most notable benefits of using an automated reconciliation system include:

1. Time Savings

Reconciliation takes a lot of time. The process can take days or weeks, depending on transaction volume and business size. Software like Solvexia enables you to complete account reconciliation in minutes.

2. Accuracy

Even with the most talented staff, human mistakes are inevitable. With automatic reconciliation, the risk of errors no longer exists. For example, Solvexia reduces errors by 90% and makes it possible to complete processes 100x faster.

3. Fraud Reduction

Automatic reconciliation makes it easier to spot issues and discrepancies early on, which can help with reducing fraud.

4. Improved Employee Satisfaction

Since manual reconciliation takes so much time and effort each month, it can feel draining for finance staff. The implementation of automated account reconciliation relieves manual work, which can lead to improved staff motivation and morale.

What are the Drawbacks of Automated Reconciliation Software?

Automated reconciliation software is highly useful for businesses of all sizes. However, there may be some pushback initially on behalf of teams when introducing new software into the business.

The greatest way to overcome this challenge is to ensure the team knows that the software is not meant to replace their jobs. Instead, automatic reconciliation software augments human capabilities and can actually lead to greater employee satisfaction.

With adequate change management and communication, it’s possible to successfully introduce automation software into your company.

Why use Automated Reconciliation Software?

If you have the option to expedite complex processes with utmost accuracy or be stuck manually dealing with paper-based and spreadsheet-driven data across disparate sources, which would you rather?

With the use of automated reconciliation software, you can rest assured that your financial documentation and ultimately financial statements are in good order and correct. Since a company’s financial health is a major deciding factor in all business decisions, having the right information can have broad implications.

Additionally, using an automatic reconciliation system means that you can:

- Save time

- Reduce costs

- Improve workplace morale

- Ensure accuracy

- Reduce mistakes

- Remove key person dependencies

- Prevent bottlenecks

- Connect data

- Leverage insights

- Increase internal control

The real question we should be asking is, “Why wouldn’t you automate your reconciliation processes?”

Why is Account Reconciliation Important?

Account reconciliation is a must-have control so businesses can check the accuracy of their internal ledger against external financial statements and documentation. It confirms that the funds exiting a business are rightfully going out and that the final accounts balances are right.

This is critical to ensure that records are up-to-date and accurate, both for decision-making purposes and compliance reasons. It also makes it more likely for businesses to realize any issues or fraud early on before it causes any negative outcomes.

What is Account Reconciliation Software?

Account reconciliation software automates the process from start-to-finish to save time, increase accuracy, and streamline workflows.

The software is able to check for errors and omissions, validate account balances, and adjust entries. Rather than having to rely on a few select people to execute account reconciliation on a monthly basis and risk paper-based delays, account reconciliation software can run at any time and is always on time.

With account reconciliation software, meeting month-end close deadlines no longer has to be a concern.

What is the Best Account Reconciliation Software?

It’s an exciting time to be at the stage of deploying an automated reconciliation system within your business, as you’re anticipating all the advantages that come along with automating this critical process.

But, choosing the right tool has to happen first. While “right” is a subjective term based on business needs and goals, take a look at our top 3 solutions that we believe are worth your while to consider:

1. Solvexia

Solvexia is a low-code platform that automates spreadsheet-driven data preparation and finance-related processes, including: reconciliation, expense management, regulatory reporting, revenue management, payment management, and more.

Solvexia unifies data from various systems, including legacy software within your business, which saves your team time.

With a drag-and-drop interface, it’s simple for anyone to use and customize for their own needs. When it comes to reconciliation, Solvexia can perform one-to-one, one-to-many, and many-to-many transaction matching with ease.

Even if your transaction volume is always on the rise, the software doesn’t sacrifice accuracy or speed and is able to reconcile across various payment providers, such as: Stripe, WorldPay, PayPal, Amazon, Shopify, and the like.

Some of Solvexia’s top features and functions include its:

- Bank-grade security

- Data analytics capabilities

- Scalability

- Drag-and-drop components

- Ease of integration

- Automated reports and customizable dashboards

2. ReconArt

ReconArt is a web-based solution that automates the data reconciliation process with its matching engine and range of features. Unlike Solvexia, ReconArt is a single solution solely designed to automate reconciliations.

It can be customized and offers approval workflow automation. Additional features include its variance analysis capabilities, audit trails, and high-volume transaction matching, exception management, reporting and analytics, and period end closing.

It is a powerful tool in its own right, but it may be hard to set complex matching rules intuitively.

3. Xero

As a cloud-based accounting software, Xero is a popular choice for small businesses and growing companies that seek to automate accounting functions like invoicing, inventory management, and bookkeeping.

With mobile expense management, users can upload receipts and employers can track expense claims in real-time. It also offers unlimited users so that business professionals can collaborate and share data between departments.

To increase its functionalities, Xero can integrate with third-party tools to serve as a scalable solution. With or without accounting experience, it is said to be user friendly and secure through its data encryption and two-factor authentication.

That being said, its range of features depends on your chosen plan, so it’s recommended to evaluate exactly what functionality you need before selecting a plan.

What are the Best Features of Reconciliation Software?

Once you’re ready to select the best reconciliation software for your business, it’s recommended to ensure that it has a certain set of features that will inevitably be desired.

These include:

- Data import: The ability to pull data from the internal ledger, as well as statements and invoices from outside sources.

- Data matching: This is a key function of reconciliation by which records are compared to ensure accuracy. The software needs to be able to locate any discrepancies or mismatched entries to ensure swift adjustments are made.

- Security: Naturally, when dealing with sensitive data, security is a top concern. Look for solutions with top-notch and constantly updated bank grade security, like Solvexia.

- Audit trail: For internal control and outside regulations, audit trails are helpful to be able to easily pull to ensure compliance.

The Bottom Line

Since reconciliation is a process that should take place in every business, it’s safe to say that every business should have an automated reconciliation system to assist. Once deployed, it will end up saving a ton of time and costly mistakes.

An automated reconciliation system like Solvexia streamlines any type of reconciliation you need to perform, scales with your business, and features drag-and-drop functionality and pre-built workflow templates so it’s easy to use for everyone.

Ready to learn more about how it works? Request a demo to see Solvexia in action.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

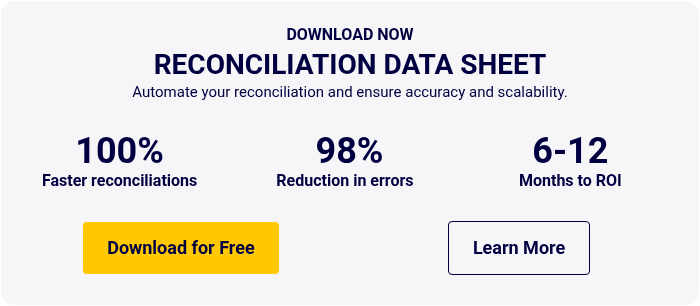

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)