GL Reconciliation Explained: Steps, Tips, and Best Practices

Being in business means keeping your business on the books—but in today’s high-stakes financial environment, a single reconciliation error can cascade into devastating consequences.

General ledger reconciliation, or GL reconciliation, is a critical process in financial management that is absolutely necessary to ensure your financial statements accurately reflect your company’s true financial status and health. In some cases, an expert bookkeeper can perform this critical reconciliation in accounting routine, while in others, a trained CFO or controller must step in to handle complex account reconciliation processes.

With your financial reporting accuracy and organizational reputation on the line—especially during critical month-end close processes—mastering GL reconciliation isn’t just best practice, it’s business survival.

Let’s explore everything you need to know about general ledger reconciliation and how automation software can help you manage your GL reconciliations with confidence and precision.

Coming Up

What is a General Ledger?

A company's general ledger is the central record of all financial transactions, playing a crucial role in financial reconciliation, categorization of accounts, and ensuring accurate financial reporting and error detection. Think of it as your business’s complete financial story, capturing every dollar that flows in and out of your organization.

General ledgers are structured to record and categorize all of a company's financial activities, typically organized into accounts and sub-ledgers to ensure consistency, accuracy, and facilitate the reconciliation process.

Understanding General Ledger Accounts

General ledger accounts are individual categories that organize your financial transactions into logical groups. Within each general ledger account, individual transactions are recorded and reviewed to ensure accuracy. Each account tracks specific types of business activity, from cash movements to equipment purchases to revenue generation.

The Five Main Account Categories

Assets

- Cash and bank accounts

- Accounts receivable (money owed to you)

- Inventory and equipment

- Property and investments

Liabilities

- Accounts payable (money you owe)

- Loans and credit lines

- Accrued expenses

- Customer deposits

Equity

- Owner's equity and retained earnings

- Common and preferred stock

- Capital contributions

Revenue

- Sales revenue from products/services

- Interest and investment income

- Other operating revenues

Expenses

- Salaries and benefits

- Rent and utilities

- Marketing and administrative costs

- Depreciation and operating expenses

What is General Ledger Reconciliation?

The general ledger (GL) is the central repository for your company’s financial data—often referred to as “the books.” It captures every financial transaction across the organization and is governed by the principle of double-entry bookkeeping, where each transaction is recorded as both a debit and a credit to ensure balance.

General ledger reconciliation is the systematic process of verifying that these entries are accurate, complete, and properly categorized. It involves regularly comparing the balances recorded in the general ledger with supporting financial documents, such as bank statements, invoices, and subsidiary ledgers like accounts receivable and accounts payable. The goal is to confirm that every transaction in the ledger is backed by a valid source and correctly posted to the appropriate account.

This process plays a crucial role in maintaining the integrity of your financial records. By identifying discrepancies and correcting errors promptly, general ledger reconciliation helps ensure the reliability of financial reporting and supports sound decision-making.

Why is General Ledger Reconciliation Important?

The stakes couldn’t be higher when it comes to reconciliation in accounting. Your general ledger data directly feeds into financial statements that shareholders, investors, and regulatory bodies rely on for decision-making. Here’s why account reconciliation matters more than ever:

- Financial Accuracy & Compliance: Incorrect entries don’t just create spreadsheet headaches—they can lead to devastating business decisions, public embarrassment, and significant regulatory fines. When your GL reconciliation process fails, the ripple effects touch every aspect of your organization. Accurate GL reconciliation is essential for maintaining a company's financial health by ensuring that financial records are reliable and losses are prevented.

- Operational Efficiency: Manual reconciliation processes are notoriously time-consuming and error-prone. A single misplaced decimal or duplicate entry can trigger hours of investigative work. However, modern financial automation solutions can process massive datasets and match records within minutes, dramatically reducing the time investment required. Proper reconciliation also ensures that financial statements reflect the true financial position of the company, free from errors or discrepancies.

- Strategic Decision Support: Accurate, reconciled financial data enables leadership to make informed decisions about budgeting, investments, and strategic planning. Clean historical data also makes it easier to identify trends and spot discrepancies before they become major issues.

Overall, the benefits of general ledger reconciliation include improved compliance, greater efficiency, and more reliable data for business decision-making.

Key Types of GL Reconciliation (with Examples)

Different types of general ledger reconciliation serve specific purposes in your month-end close process. Here are the most critical ones to prioritize:

Bank Reconciliation

Bank reconciliation compares your GL cash balances with bank statements to catch timing differences, fees, and potential fraud.

Example: Your GL shows $50,000 but your bank statement shows $48,500. The $1,500 difference could be outstanding checks or unrecorded bank fees.

Accounts Payable & Receivable Reconciliation

Accounts Receivable: Ensures outstanding customer invoices match your AR aging reports.

Accounts Payable: Verifies vendor balances match outstanding invoices to maintain supplier relationships and avoid late fees.

Example: Customer X shows $25,000 owed, but their $10,000 payment wasn't properly applied, creating collection inefficiencies.

Intercompany & Fixed Asset Reconciliation

Intercompany: Eliminates transactions between subsidiaries in consolidated statements to prevent double-counting.

Fixed Assets: Verifies GL balances match your asset register, including proper depreciation calculations.

Example: A $100,000 intercompany loan appears as both an asset and liability without proper reconciliation, inflating your balance sheet by $200,000.

These account reconciliation types work together to protect your financial integrity and support accurate financial reporting.

Step-by-Step GL Reconciliation Process

Every organization should document their general ledger reconciliation policy, but the core account reconciliation process follows these standard steps:

1. Understand Company Policies

Review your organization's accounting principles, depreciation methods, and reconciliation procedures before beginning. Consistency with established policies ensures accurate financial reporting.

2. Gather Supporting Documentation

Compile all necessary records including bank statements, subsidiary ledgers, invoices, and the general ledger trial balance. Missing documentation derails the entire process.

3. Compare & Analyze Data

Review documentation to ensure transactions are accurately reflected. Flag unusual or suspicious items immediately—early detection prevents small errors from becoming major problems.

4. Investigate Discrepancies

Research any anomalies thoroughly. Determine if differences are due to timing, data entry errors, or potential fraud. Prepare correcting journal entries as needed.

5. Document Everything

Record all findings, adjustments, and corrective actions taken. Create a clear audit trail for compliance and future reference. This documentation is crucial for month-end close efficiency.

6. Obtain Approval

Submit completed reconciliations for management review and approval. GL reconciliation must be finalized before financial statements can be released, making timely completion critical for reporting deadlines.

This structured approach to reconciliation in accounting ensures accuracy, compliance, and audit readiness while streamlining your month-end close process.

Common Errors in GL Reconciliation and How to Avoid Them

Even with the best intentions, general ledger reconciliation can be error-prone when performed manually. Here are the most frequent mistakes and practical solutions to prevent them:

Data Entry Errors

The Problem: Manual data entry creates opportunities for incorrect amounts, duplicate entries, and transposed numbers. A single typo can cascade into hours of investigation.

The Solution: Implement automated data capture and validation rules. Use import functions instead of manual entry whenever possible, and establish review checkpoints for high-risk transactions.

Scattered Documentation

The Problem: When supporting documents are spread across desktops, spreadsheets, and multiple systems, critical information gets lost or overlooked during account reconciliation.

The Solution: Centralize all reconciliation documentation in a secure, accessible location. Establish clear file naming conventions and ensure your team knows exactly where to find—and store—supporting materials.

Inconsistent Timing

The Problem: Irregular reconciliation schedules lead to transaction buildups, making errors harder to identify and resolve. Delayed month-end close processes create unnecessary pressure and increase mistake likelihood.

The Solution: Establish fixed reconciliation schedules (daily, weekly, or monthly) with clear deadlines. Communicate expectations to all stakeholders and build reconciliation tasks into your standard month-end close process.

Prevention Through Automation

Modern automation in finance solutions eliminate most manual reconciliation errors by automatically importing data from multiple sources, standardizing formats, and flagging discrepancies for review. This approach ensures consistent, accurate financial reporting while freeing your team to focus on analysis rather than data entry.

The key is recognizing that these errors aren't inevitable—they're preventable with the right processes and tools in place.

How Does General Ledger Reconciliation Software Work?

As you know, the GL reconciliation process can take up a lot of valuable time. Since data is stored across multiple sources and must be compared side-by-side, manual reconciliation is less than optimal. Without software, it means that your team is spending time to both locate source documentation and then go through it line by line.

Luckily, GL reconciliation uses the power of technology and automation to make the process efficient. Accounting software can digitize and streamline the reconciliation process, reducing manual work and supporting compliance with accounting standards.

GL reconciliation software imports necessary data from all systems, including ERP and General Ledger systems, credit card statements, banks and all other sources of value. It automatically compares the data. These tools automate general ledger reconciliation to reduce errors, improve efficiency, and ensure greater accuracy in matching and categorizing transactions.

It’ll auto-certify when data matches between sources. If data is inconsistent, it will identify and alert your team. This way, your financial team can spend their time on high-value tasks and only be involved in the process when needed for investigative purposes. From data importation, comparison and storage, the software system can do it all.

The top of the line GL reconciliation software provides your business with:

- Automated reviews and workflows

- Safe storage of data and information

- Audit trails

- Storage of all applicable policies for reference

- Reconciliation templates and easy ways to standardize the process

Benefits of Automating General Ledger Reconciliation

While general ledger reconciliation is mandatory for businesses, automation transforms this necessary process from a time-consuming burden into a strategic advantage. Here's how automation in finance enhances traditional reconciliation benefits:

1. Speed & Efficiency

Manual Process: Hours or days spent gathering data and cross-checking documents.

Automated Process: Minutes to complete reconciliations that previously took your team all day, freeing resources for strategic analysis.

2. Enhanced Accuracy

Manual Process: Human error in data entry and calculations creates ongoing risk.

Automated Process: Eliminates transcription errors and ensures consistent calculations across all account reconciliation activities.

3. Real-Time Fraud Detection

Manual Process: Anomalies discovered weeks or months after they occur.

Automated Process: Immediate flagging of suspicious transactions and discrepancies while they're still manageable and correctable.

4. Streamlined Compliance & Audit Readiness

Manual Process: Scrambling to compile documentation and supporting materials.

Automated Process: Complete audit trails and organized documentation available instantly, making financial reporting seamless and stress-free.

5. Improved Decision-Making Speed

Manual Process: Waiting for month-end reconciliation to understand financial position.

Automated Process: Real-time insights enable faster, more informed business decisions throughout the month.

6. Cost Control & ROI

Automation typically pays for itself within months by reducing the time spent on manual reconciliation in accounting processes. Teams report time savings of 70-90% on routine reconciliation tasks, allowing finance professionals to focus on value-added analysis instead of data entry.

The bottom line: automation doesn't just make reconciliation faster—it makes your entire month-end close process more reliable, compliant, and strategically valuable.

How Solvexia Streamlines GL Reconciliation

Automation in finance transforms GL reconciliation from a time-consuming manual process into an efficient, error-free operation. Solvexia's account reconciliation platform can reduce reconciliation time by up to 98%, turning what once took days into minutes.

Automated Data Processing & Matching

Solvexia's process-centric application handles all data processing and matching automatically. The cloud-based software can reconcile millions of transactions in seconds, pulling data from all integrated systems to eliminate disparate or missing information.

Key capabilities:

- Centralized data storage across all systems

- Automatic transaction matching and exception identification

- Real-time processing of high-volume transaction data

Smart Exception Management

When discrepancies arise, Solvexia immediately notifies your team about exceptions that need review, correction, and approval. Advanced visualization tools make investigations transparent and faster to complete.

The result: Your team focuses only on exceptions that require human judgment, not routine data verification.

Standardized Process Control

Every reconciliation runs through a standardized process that's easily managed and deployed. Once completed, the process is stored and can be executed automatically according to your month-end close process schedule.

Executive-Ready Reporting

Solvexia transforms general ledger reconciliation data into actionable business insights. Customizable dashboards provide executives with real-time overviews of company performance, spending patterns, and income trends.

Beyond compliance: While GL reconciliations are necessary for financial close processes, Solvexia's reporting capabilities turn reconciliation data into strategic decision-making tools.

Real-Time Visibility

Every reconciliation is reflected on dashboards accessible to authorized users at any time. This transparency ensures your entire finance team stays informed about financial reporting status and can respond quickly to any issues.

Solvexia doesn't just automate reconciliation—it elevates your entire reconciliation in accounting process from reactive compliance to proactive financial management.

The Bottom Line

The GL reconciliation process can be streamlined and performed with accuracy with the help of automation solutions. All businesses must have accurate books. Your financial status impacts your decisions. With business moving quickly, it’s beneficial to ensure that your finances are in order so that you can make the right decisions.

With automation solutions like Solvexia, you can perform accurate and timely reconciliation processes in no time. From data integrations to secure data storage and easy-to-read reports, and by adhering to data reconciliation best practices, there’s nothing you’ll be lacking when it comes to GL reconciliation.

To see how Solvexia can help your company perform its GL reconciliations, request a demo!

FAQ

What is the GL process?

The GL (General Ledger) process involves recording, classifying, and summarizing financial transactions into key account categories such as assets, liabilities, equity, revenue, and expenses. It ensures financial data is accurate and forms the foundation of a company’s financial reporting.

What is the difference between bank reconciliation and general ledger reconciliation?

Bank reconciliation focuses solely on matching internal cash account balances with external bank statements. General ledger reconciliation is broader, comparing all types of ledger accounts — such as receivables, payables, and fixed assets — against supporting records to ensure accuracy.

How to reconcile a bank statement with a general ledger?

To reconcile a bank statement with the general ledger:

- Compare GL cash balances with the bank statement.

- Identify and adjust for timing differences (e.g., outstanding checks, deposits in transit).

- Investigate discrepancies.

- Post necessary journal entries to resolve mismatches.

- Confirm the final balances match.

What are the 5 elements of the general ledger?

The general ledger includes five main account categories:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

Each category captures specific financial transactions to maintain accurate records.

How do you balance a general ledger account?

To balance a GL account:

- Review all transactions recorded under the account.

- Ensure each debit has a corresponding credit.

- Post any adjusting journal entries for errors.

- Recalculate totals so that debits and credits are equal.

- Confirm the balance matches supporting documents or subledgers.

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

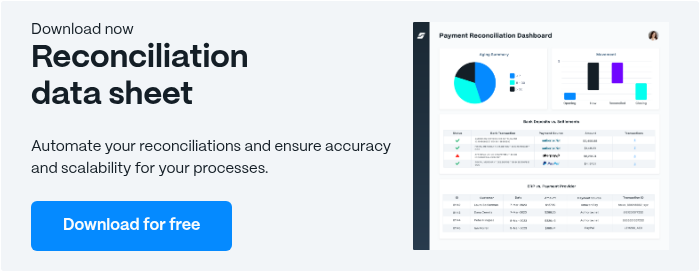

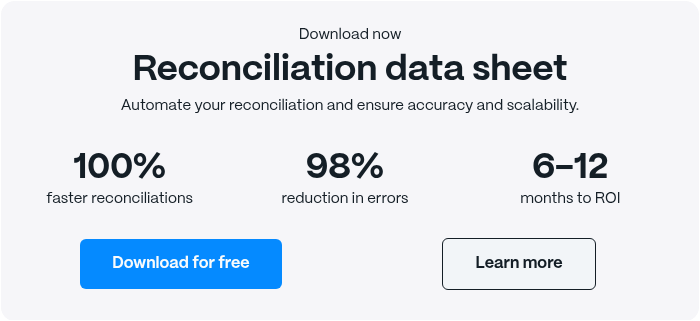

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)