Monthly Balance Sheet Reconciliations Best Practices & Tips

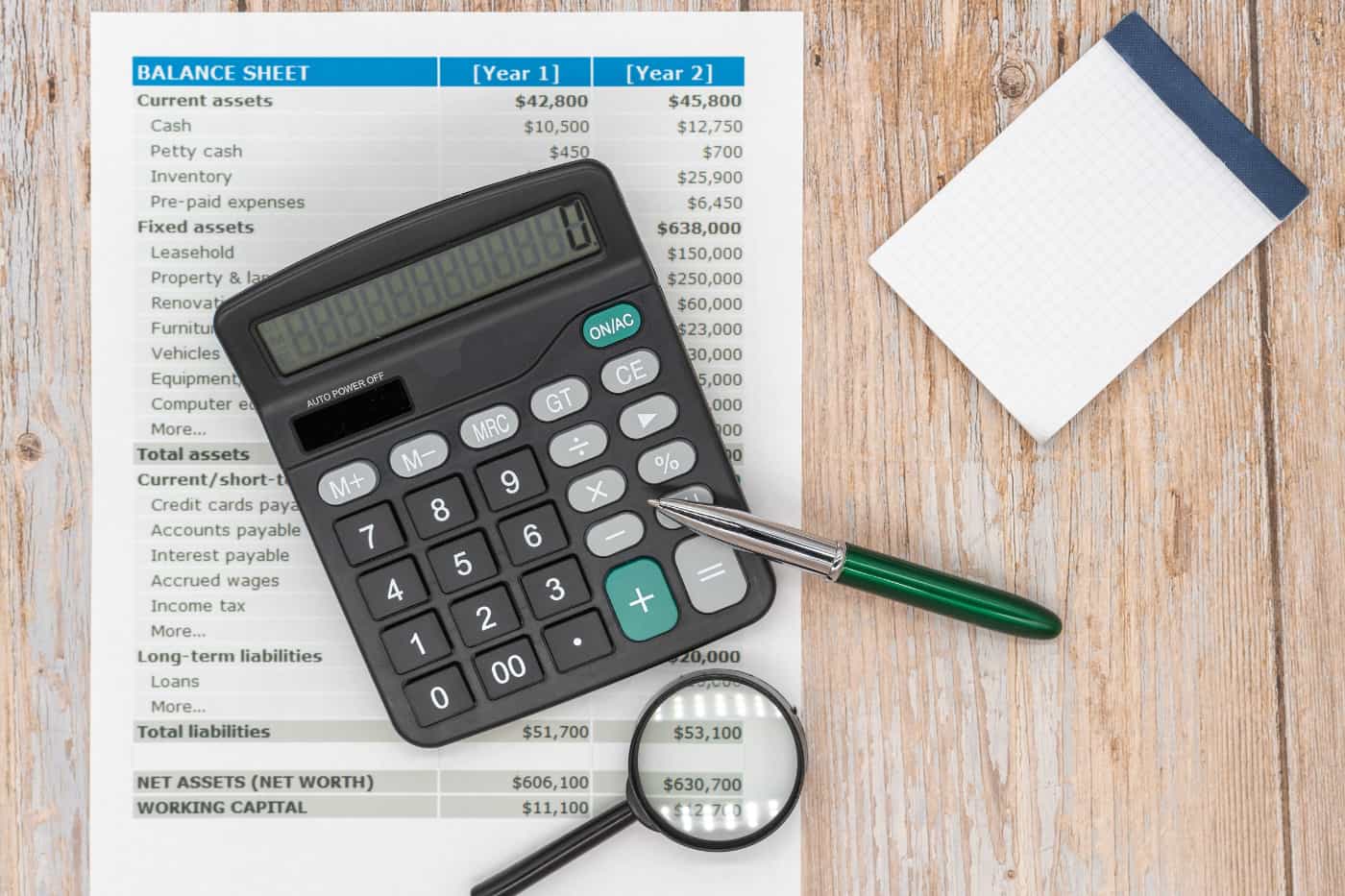

Monthly balance sheet reconciliations help you to make sure that your company’s assets, liabilities, and equity amounts are correct.

To fulfill the financial reporting process, a balance sheet is one of the most important parts of the puzzle, so reconciliation shouldn’t hold you back in terms of timing.

We’re going to share how you can streamline your balance sheet reconciliation steps with the addition of finance automation software to complete your balance sheet reconciliation checklist.

Let’s get to it!

Coming Up

What is Balance Sheet Reconciliation?

Why is Financial Close Important?

What are the Challenges of Financial Close?

What are the Key Pillars of the Financial Close Process?

What is the Role of Balance Sheet Reconciliation in the Close Process?

What are the Key Elements of Balance Sheet Reconciliation?

What are the Steps of Balance Sheet Reconciliation?

What are the Common Challenges of Balance Sheet Reconciliation?

How to Overcome the Challenges of Balance Sheet Reconciliation?

What are the Costs of Manual Balance Sheet Reconciliation?

How Automation Improves Monthly Balance Sheet Reconciliation?

What is Balance Sheet Reconciliation?

Just like death and taxes are certain, so is the monthly close process when accountants “close the books.” This process actually refers to executing monthly balance sheet reconciliations, in which the finance team confirms that the figures on the financial statements are all right.

The close process may take place at the end of the month, quarter, or year, but no matter when it takes place, it’s of utmost importance for the numbers to be correct. The balance sheet reconciliation process includes reconciling the following accounts, including:

- Cash

- Debt

- Equity

- Fixed assets

- Prepaid expenses

- Deferred revenue

- Credit cards

- Accounts receivable

- Accounts payable

The reconciliation process requires a review of the general ledger with external documentation and supporting information to verify that the general ledger’s balance is correct. Supporting documentation spans bank statements, payment schedules, subsidiary ledgers, and the like.

Why is Financial Close Important?

Every business decision that is made is either based on the company’s financial health or will affect it inevitably. That’s why it’s undeniable that every business owner, executive, and stakeholder would want to know the right figures at any given moment.

By executing the financial close process consistently and accurately, every relevant party gains financial visibility and can comply with regulations. These figures are used to generate financial statements and submit to regulatory bodies, as well. So be it for internal or external review, the numbers must be in order.

When businesses are able to complete the close process both accurately and speedily, they gain a leg up on the competition, increase confidence in their decision making capabilities, and decrease risks.

What are the Challenges of Financial Close?

The value of the financial close is known by all finance teams, as are the challenges it can create.

Most would agree that one of the greatest pains is to access all the required data as it is often stored across multiple systems. The time spent collecting the necessary information is time that can be better spent performing analysis.

This opportunity cost, combined with the cumbersome and tedious process of repetitively performing the tasks, can be a drain on finance teams.

With finance automation software, the data is connected through APIs and centralized in a single location.

Then, the system executes the necessary transaction matching to remove manual labor from the equation. This gives finance more time to focus on high value tasks and providing greater insights to the business.

What are the Key Pillars of the Financial Close Process?

The financial close process entails similar steps for every business because it’s based on four key pillars, namely:

1. Close checklist:

There’s a checklist of processes to go through to complete the overall close process.

2. Journal Entry:

This involves posting journals and confirming they are right.

3. Balance sheet Reconciliation and Certification:

Back in the day, it was the responsibility of auditors to ensure that accounts are accurately reflected. Nowadays, it’s up to the business’ finance team itself to go through the checks and balances to confirm everything is in order.

This does add extra onus on the company, but at the same time, it provides an opportunity to improve internal controls and visibility.

4. Intercompany:

For parent companies, it’s necessary to ensure the balance sheets are in good standing across each subsidiary.

What is the Role of Balance Sheet Reconciliation in the Close Process?

Balance sheet reconciliation is to the financial close process as an engine is to a car - it’s vital to make the business run.

Monthly balance sheet reconciliations provide a business’ leaders with the information they need to make informed decisions based on the company’s financial status. At the same time, this information is used by insurers and bankers for creditworthiness evaluation.

Along with bankers and insurers, investors look at the company’s financial health to deduce whether or not they’d like to invest.

During the financial close, it’s advisable to perform reconciliations on the high-risk accounts that will have the greatest impact on the balance sheet.

What are the Key Elements of Balance Sheet Reconciliation?

A balance sheet is the material representation of the known balance sheet formula:

Assets - Equity Liabilities

In order to perform a balance sheet reconciliation, it requires that the following elements are properly managed:

- Reconcile every account in the balance sheet

- Have a clearly stated workflow, including responsible parties

- Have a risk ratings applied to prioritize which accounts must be focused on and when

- Fulfill any manual investigations when necessary

There are a lot of moving parts, especially if you’re looking to conduct monthly balance sheet reconciliations. The amount of data, transaction volume, accounts, and people involved can add complexity to the workflow.

Luckily, finance automation software helps to remove the complexity and chaos from the workflow by automating the bulk of it. Finance automation software can connect your data systems, conduct transaction matching, and even help to automate reporting.

What are the Steps of Balance Sheet Reconciliation?

Balance sheet reconciliation workflows typically look like this:

- Gather all supporting documentation

- Compare the documentation with listed account balances internally

- Adjust journal entries where necessary

- Add values to the balance sheet (known as “footing”the balance sheet to make assets equal to liabilities and equity

While the steps can be listed quickly, they tend to be time-consuming if performed manually. With month-end close deadlines always approaching, it makes sense why you’d want to streamline this process above all due to its great importance.

What are the Common Challenges of Balance Sheet Reconciliation?

Balance sheet reconciliations are a must-do, but they should not be a must-suffer-from-doing situation.

To be able to reap the benefits of automation software and understand what there is to gain from streamlining the process, let’s quickly review what common challenges you’re likely facing:

1. Separate Data

One of the most commonly reported challenges of balance sheet reconciliation, or any type of reconciliation for that matter, is disparate data. This poses a challenge for accounting teams when they have to dig up statements and work across desktops, systems and spreadsheets.

2. Manual Mistakes

Naturally, humans make mistakes (no matter how experienced they may be). It’s understandable, especially as the use of various payment processors expands and transaction volume grows.

3. Wasted Time

Cross-referencing records and manually sourcing data take a lot of time, which presents immense opportunity cost, particularly for high-level teams.

How to Overcome the Challenges of Balance Sheet Reconciliation?

Despite the hurdles you may be facing or have faced in the past, there are ways to rise above when conducting monthly balance sheet reconciliations, or quarterly or annually.

You can:

1. Leverage automation solutions

Remove the risk of key person dependencies, bottlenecks, and manual errors with finance automation software that does the work for you. By doing so, you can free up your team’s time to focus on high-level tasks, as well as increase confidence in your numbers.

With automation software running, you get to benefit from being able to run processes 100x faster and be up-and-running in minutes (as opposed to months). The drag-and-drop solution is easy for anyone to use and leads to 90% fewer errors, plus rich insights for better decision-making!

2. Make use of templated workflows

When you implement no-code automation software, you can rely on its library of pre-configured workflows to help you get up and running faster. This makes it easy to standardize your workflows across your geographic locations and offices, too.

What are the Costs of Manual Balance Sheet Reconciliation?

Monthly balance sheet reconciliations are exactly that - continuous and monthly. So, when you’re stuck doing them manually, you have a lot of costs that can add up, such as:

1. Time

Your finance team is spending valuable time going line-by-line through data rather than using that time on strategic work.

2. Costs

Automation isn’t intended to remove the need for your human resources. Instead, it augments your workforce to help you cut costs of mistakes, as well as reinvest their time in analytics and forecasting.

3. Risks

Manual errors also lead to compliance risk and an increased chance of fraud.

How Automation Improves Monthly Balance Sheet Reconciliation?

With automation software implemented, you get to overcome the challenges and costs associated with manual monthly balance sheet reconciliations. Modern accounting, with the aid of automation, provides:

- Time savings

- Cost savings

- Risk reduction

- Error reduction

- Maximized productivity

- Removal of key person dependencies

- Elimination of bottlenecks

Out-of-the-box automation software can be up and running in under 30 minutes and without the need of an IT team.

Since it’s based on drag-and-drop functionality, anyone can use it and design customizable workflows to then execute at the click of a button.

Automation software can streamline monthly balance sheet reconciliations, along with expense management, regulatory reporting, rebate management, and more!

Wrap Up

There’s no getting around performing monthly balance sheet reconciliations, but there is getting around the pain that comes along with it.

With finance automation software smoothly running within your business, your finance team will have more time to allocate to sophisticated tasks and thinking. All the while, your business benefits from accurate financial statements, reduced mistakes, and increased visibility and insights.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)

%25201.webp)