Accounting Cycle Explained: Steps, Examples & Best Practices

The accounting cycle is the backbone of financial management for businesses of all sizes. This systematic process transforms daily transactions into accurate financial statements that guide business decisions. Every financial activity—from sales to inventory management—flows through this structured framework.

In simple terms, the accounting cycle is a repeatable sequence of procedures that properly records, classifies, and summarizes financial information. The process begins when a transaction occurs and ends with financial statements and closing the books.

With today's increasing transaction volumes, automation tools are transforming the accounting cycle—reducing errors, accelerating processes, and freeing finance professionals to focus on strategic analysis rather than data entry.

Coming Up

What is the Accounting Cycle?

The accounting cycle is a systematic accounting process businesses follow to record, analyze, and report financial activities during a specific period. It tracks transactions from their occurrence to financial statements and closing the books.

This standardized framework ensures accuracy in financial reporting. By following it, businesses maintain organized records, detect errors, and generate reliable statements that reflect their true economic performance.

Accounting cycles vary in frequency—monthly cycles provide frequent insights, quarterly cycles align with regulatory demands, and annual cycles suit small businesses for tax purposes. Each new period begins as the previous one ends, creating a continuous cycle of financial tracking.

Understanding why the accounting cycle is important helps businesses ensure accurate transaction recording and financial statement preparation, promoting accountability and process management.

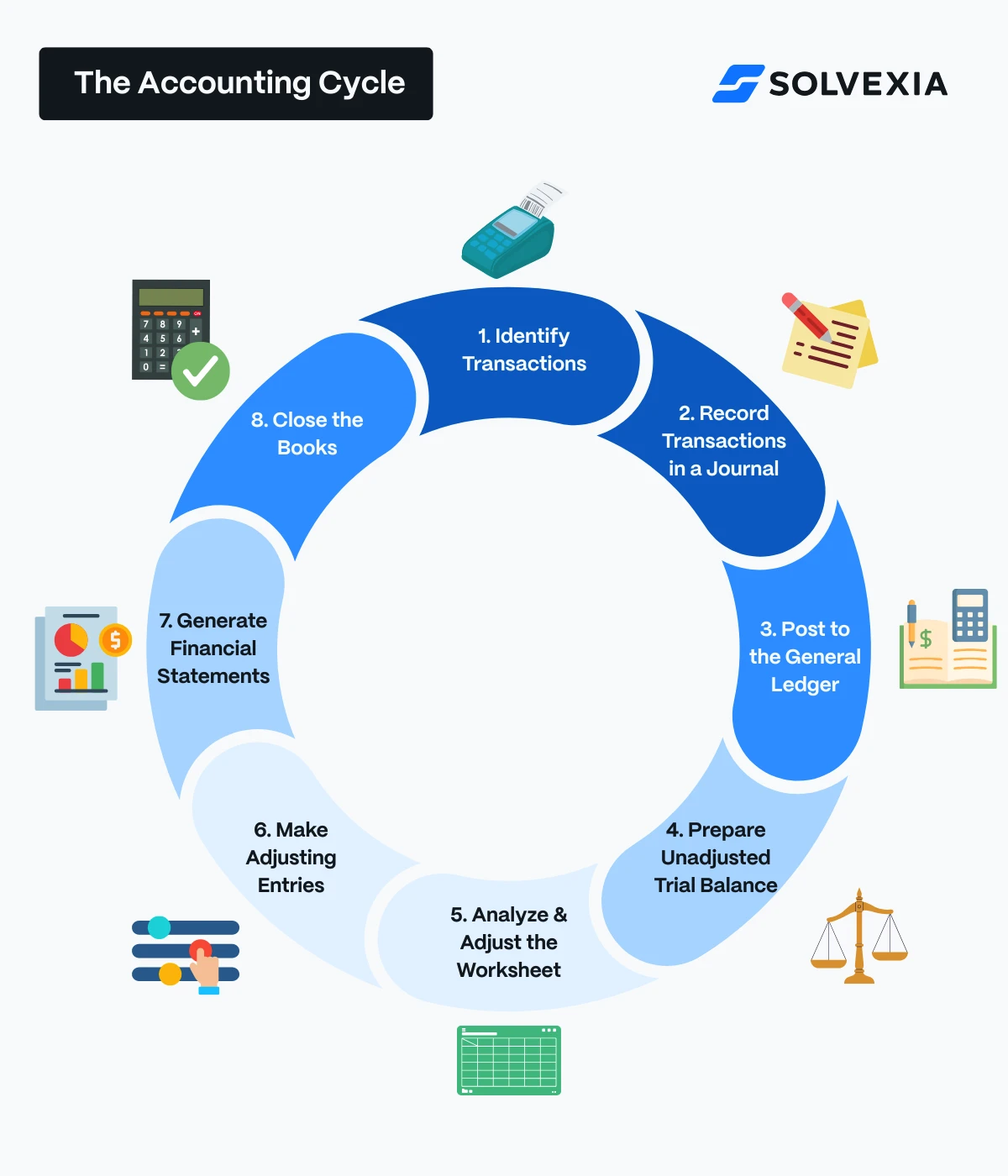

The process consists of 8 distinct steps that guide accountants through documenting and reporting financial activities. These steps create a comprehensive checklist ensuring all financial information is properly recorded, verified, and presented.

The 8 Steps in the Accounting Cycle

Step 1: Identify Transactions

Every accounting cycle begins with identifying the business transactions that have occurred during the period. A financial transaction is any activity that affects the company’s financial position and can be measured in monetary terms.

Accurately recording the business's financial transactions in both journal entries and the general ledger is crucial for maintaining precise financial records and adhering to accounting principles.

Examples of transactions include:

- Sales of products or services to customers

- Purchase of inventory, supplies, or equipment

- Payment of expenses such as rent, utilities, and salaries

- Receipt of payments from customers

- Loan payments or new financing activities

- Returns or refunds issued to customers

For accurate financial reporting, all transactions must be captured with their correct date, amount, and nature. Many businesses use point-of-sale (POS) systems or specialized accounting software to automatically record sales transactions, while other transactions may need manual documentation.

Step 2: Record Transactions in a Journal

Once transactions are identified, they must be recorded as journal entries in a journal—often called the “book of original entry.” The method of recording depends on whether the business uses cash or accrual accounting:

- Cash accounting: Transactions are recorded only when cash actually changes hands. For example, a sale is recorded when the payment is received, not when the goods are delivered.

- Accrual accounting: Transactions are recorded when they occur, regardless of when cash is exchanged. For example, a sale is recorded when the goods are delivered, even if payment comes later.

It is crucial to maintain chronological order when recording transactions to ensure accuracy and compliance with accounting standards.

Most businesses use double-entry bookkeeping, where each transaction affects at least two accounts. For every debit entry in one account, there must be an equal credit entry in another account or accounts. This system ensures that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

Step 3: Post to the General Ledger

After recording transactions in the journal, the next step is to transfer or “post” them to the General Ledger (GL). Posting to the general ledger is essential as it organizes and summarizes all of a company’s financial transactions by account.

The general ledger typically categorizes transactions into five main types of accounts:

- Assets (what the company owns)

- Liabilities (what the company owes)

- Equity (owners’ investment and retained earnings)

- Revenue (income from business activities)

- Expenses (costs incurred in business operations)

Maintaining accurate accounting records is crucial for documenting transactions, preparing financial statements, and ensuring accountability.

Proper categorization is crucial as it affects financial statement accuracy and business analysis. For instance, miscategorizing an expense as an asset would incorrectly inflate the company’s reported profits and asset value.

Step 4: Prepare an Unadjusted Trial Balance

Once all transactions are posted to the general ledger, an unadjusted trial balance is prepared. This is essentially a worksheet listing all general ledger accounts with their debit or credit balances.

The double entry bookkeeping system plays a crucial role in maintaining accuracy by ensuring that total debits equal total credits. The primary purpose of the trial balance is to verify that total debit balances equal total credit balances, confirming that the books are mathematically balanced. If they don’t match, there’s an error somewhere in the recording or posting process.

Common errors that may cause an unbalanced trial balance include:

- Recording an incorrect amount

- Posting a debit as a credit (or vice versa)

- Omitting a transaction

- Double-posting a transaction

- Simple calculation errors

Step 5: Analyze & Adjust the Worksheet

Even if the trial balance shows equal debits and credits, the accounts may still need adjustments. This step involves analyzing the worksheet to identify necessary adjustments through adjusting journal entries for:

- Accruals: Recognizing revenues earned but not yet recorded, or expenses incurred but not yet paid

- Deferrals: Adjusting for revenues received in advance but not yet earned, or expenses paid in advance but not yet incurred

- Missing transactions: Adding any transactions that were overlooked

- Errors: Correcting any mistakes in earlier entries

After making these adjustments, it is crucial to prepare an adjusted trial balance to ensure that all debit and credit balances are equal and accurate.

For example, if a company pays $12,000 for a year of insurance coverage in January, by June (halfway through the year), an adjustment would be needed to recognize that $6,000 of that prepaid expense has now been used up.

Step 6: Make Adjusting Entries

Based on the analysis in step 5, formal adjusting journal entries are recorded in the journal and posted to the general ledger. These entries ensure that revenues and expenses are recognized in the correct accounting period, following the matching principle.

Ensuring accurate account balances is crucial for transferring values from temporary accounts to permanent accounts during the closing entries, which is essential for accurate financial reporting and accountability.

Common adjusting entries include:

- Depreciation: Recording the portion of a long-term asset’s cost as an expense for the period

- Prepaid expenses: Recognizing the used portion of previously paid expenses, such as insurance or rent

- Unearned revenue: Recording the portion of advance payments that have now been earned

- Accrued expenses: Recording expenses that have been incurred but not yet paid, such as utilities or salaries

- Accrued revenue: Recording revenue that has been earned but not yet received

Step 7: Generate Financial Statements

After all adjustments have been made, the company can prepare its financial statements, creating financial statements that provide a comprehensive picture of its financial performance and position:

- Income Statement: Shows revenues, expenses, and profit or loss over the accounting period

- Balance Sheet: Presents assets, liabilities, and shareholders’ equity at the end of the accounting period

- Cash Flow Statement: Details how cash moved into and out of the business during the period, categorized by operating, investing, and financing activities

The statement of cash flows is particularly important as it provides insights into the liquidity and solvency of the business, which are crucial for management review and compliance purposes.

These statements are crucial for management decision-making, investor analysis, and regulatory compliance.

Step 8: Close the Books

The final step in the accounting cycle is closing the books, which prepares the accounts for the next accounting period. This process involves recording closing entries. These entries transfer balances from temporary accounts to permanent accounts, ensuring the books are ready for the new period. This process involves:

- Transferring net income or loss to the retained earnings account

- Resetting income and expense accounts to zero (since these are temporary accounts that measure activity during a specific period)

- Generating a post-closing trial balance to verify that all temporary accounts have been closed properly

- Creating backup copies of the financial records

- Reviewing financial performance against previous periods and budgets

Additionally, closing the books includes the process of closing revenue and expense accounts. This ensures that all temporary accounts are accurately transferred to a permanent account, maintaining the integrity of the accounting cycle.

Closing the books provides a clean slate for recording transactions in the new accounting period while preserving the cumulative financial history in the permanent accounts (assets, liabilities, and equity).

Importance of the Accounting Cycle

The accounting cycle is essential for businesses to ensure the accuracy and completeness of their financial records. By systematically following the steps of the accounting cycle, businesses can identify areas for improvement and optimize their operations. This process provides stakeholders with accurate and timely financial information, which is critical for making informed decisions.

One of the key benefits of the accounting cycle is that it helps ensure compliance with accounting standards and regulations. Accurate financial reporting is crucial for maintaining the integrity of financial records and building trust with stakeholders, including investors, creditors, and customers. Compliance with these standards also helps businesses avoid legal issues and penalties.

Moreover, the accounting cycle provides a framework for financial planning, decision-making, and analysis. By maintaining accurate and complete financial records, businesses can better understand their financial position and performance. This understanding allows for more effective budgeting, forecasting, and strategic planning, which are critical for achieving long-term success.

In summary, the accounting cycle is a critical component of financial management and decision-making. It ensures that financial records are accurate, complete, and compliant with accounting standards and regulations. By following the accounting cycle, businesses can provide stakeholders with reliable financial information, build trust, and make informed decisions that drive long-term success.

How to Automate the Accounting Cycle

Automating the accounting process can enhance efficiency and reduce errors. Modern technology now allows businesses to automate significant portions of the accounting cycle, enhancing accuracy while reducing workload.

An accounting system facilitates various accounting processes such as posting to the general ledger, closing the books, and preparing journal entries. It automates tasks, records transactions, and produces necessary financial reports, ensuring accurate and efficient financial management.

Benefits of Automating the Accounting Cycle

Automation transforms traditional accounting by:

- Minimizing human error: Reducing data entry mistakes and miscalculations

- Increasing efficiency: Completing in minutes what would take days manually, freeing the accounting team to focus on analysis

- Improving consistency: Ensuring the same procedures are followed every time

- Enabling real-time insights: Providing up-to-date financial information on demand

- Strengthening controls: Enforcing proper segregation of duties and audit trails

Solvexia's Approach to Accounting Automation

Solvexia offers comprehensive solutions for automating key accounting processes:

Automatically compares data from multiple sources, flags discrepancies, and facilitates resolution—particularly valuable during trial balance preparation.

Streamlines repetitive tasks including journal entry creation, ledger posting, trial balance generation, and financial statement preparation, freeing accounting professionals to focus on analysis rather than data processing. Solvexia automates key accounting activities, ensuring that all financial data is organized and categorized efficiently.

Financial Reporting

Generates accurate reports by pulling data from various systems, applying standardized calculations, producing scheduled reports, and distributing them automatically to stakeholders.

Real-World Applications

7-Eleven Philippines: From Days to Minutes

With 3,400+ stores processing 500,000 daily transactions, 7-Eleven implemented automation that:

- Reduced reconciliation time from days to minutes (100x faster)

- Enabled daily exception reports for immediate investigation

- Decreased fraud and missing cash at store level

- Improved staff work-life balance

- Supported scalable growth

Emma Sleep: 500% Faster Reconciliations

This global sleep brand operating in 30+ countries achieved:

- 100,000 transactions matched daily across 30+ payment providers

- 500% faster reconciliations

- Shift from weekly to daily completion

- Elimination of key person dependency

- Reduced cross-department friction

HeartFlow: Streamlining Complex Calculations

This medical technology company automated rebate management across 440 healthcare sites:

- Processing 80,000 transactions daily

- Saving 2 full-time equivalent positions

- Managing complex customer hierarchies

- Integrating seamlessly with multiple systems

- Enabling single-user management of the entire program

Final Thoughts

The accounting cycle is far more than bookkeeping—it’s the foundation for financial transparency, compliance, and informed decision-making. Following these eight steps ensures financial records accurately reflect economic reality and adhere to essential accounting principles.

As businesses grow more complex, manual accounting becomes increasingly challenging. Errors multiply, deadlines slip, and insights arrive too late when finance teams get bogged down in processing.

Automation offers a powerful solution. Tools like Solvexia dramatically reduce processing time, eliminate errors, and free finance professionals to focus on strategic analysis.

Understanding the significance of the fiscal year in financial reporting is crucial, as it impacts how financial statements are prepared and how financial transactions are recorded.

Whether for a small business or multinational corporation, combining the structured accounting cycle with modern automation transforms finance from a back-office function to a strategic business partner.

Ready to transform your accounting processes? Explore how Solvexia can help your finance team reduce manual effort, increase accuracy, and provide faster insights through automated reconciliation and reporting.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)